Nina Notman talks to some of the companies launching chemical recycling technologies for single-use plastics

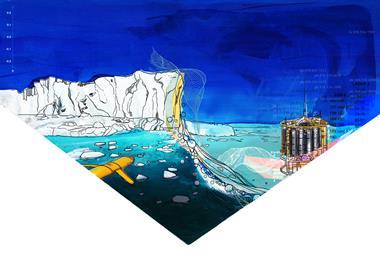

By 2050, the oceans will contain more plastic by weight than fish – if we don’t change our ways. This was the headline-grabbing conclusion of a 2016 report from the Ellen MacArthur Foundation, a UK environmental charity established by the solo long-distance yachtswoman. The 2017 BBC documentary series Blue Planet II, presented by David Attenborough further turned the tide of public opinion against plastic.

A huge backlash against single-use plastics, in particular, ensued. But turning single-use plastic into public enemy number one is a simplistic response to a very complicated issue. Often plastic is the right material for the job, both logistically and environmentally. We might assume, for example, that if we’ve forgotten our refillable bottle, purchasing a drink in a glass bottle is a sounder environmental choice than one in a plastic bottle. But their higher weight means glass bottles are more polluting to transport than plastic ones. Then there are the shrink-wrapped cucumbers which have come under scrutiny, when actually this plastic coating extends shelf lives by days thus avoiding food wastage. And have you ever tried to drink a McDonald’s milkshake using its new paper straws? Not only do they fall apart on the job (don’t judge me, I parent small boys), but the restaurant has now admitted that they can’t be recycled anyway, meaning recyclable plastic may well have been a better choice.

Over $80 billion of plastic packaging material is lost from the global economy each year

Reducing our reliance on single-use plastic is only ever going to be partial solution to the pollution it causes. A complementary approach is to build a circular economy for plastic. A future where the resources in discarded plastic are recovered and regenerated into new plastic. Again and again and again.

Circular aspirations

A circular economy for plastic would also slash the volume of new petrochemical feedstock needed to be extracted for its production. Another huge environmental bonus, it makes sense financially too: $80–120 billion of plastic packaging material is lost from the global economy each year after just one use, according to the 2016 Ellen MacArthur Foundation report.

We are currently far from this circular ideal, however. Plastic recycling is on the increase – between 2008 and 2018, for example, plastic waste recycling in the EU has increased by almost 80% – but overall proportions are still low. In the EU in 2017, 30% of all generated plastic was recycled, with levels varying significantly between countries. In the US, in the same year, just 8.4% of plastic generated was recycled.

And, unlike with paper, glass and metal recycling, most plastic waste isn’t recycled into similar quality items. It is mechanically recycled into lower-quality plastics, a process often called downcycling. Examples of products produced from recycled plastic bottles include insulation, clothing fibres and furniture – many of which are not easily recycled again, so it’s not a circular system. In addition, some plastic types are logistically unsuitable or financially unviable for mechanical recycling. Collected waste plastic that is not mechanically recycled is either sent to landfill or incinerated to recover energy.

An alternative technology for recycling plastic is starting to gain traction: chemical recycling. The goal here is to break long plastic polymer chains down into shorter hydrocarbons and then rebuild them into brand new polymers, suitable for any purpose.

In the US, just 8.4% of plastic generated was recycled in 2017

Chemically recycling plastics isn’t a new concept. A number of companies, including chemical giant BASF, looked at this in the mid-1990s. But contamination, especially from PVC (polyvinylchloride), caused major issues. ‘PVC breaks down to give chlorine which is very corrosive,’ explains Kevin Van Geem, an expert in the chemical recycling of plastics at Ghent University in Belgium. System leaks and small fires were commonplace. Today, advanced sorting technology has eliminated this issue. And the chemical recycling technology has matured to be able to better handle food waste.

A shift in public opinion is also helping to drive this technology forward today, explains Van Geem. People worldwide are objecting to plastic pollution more and are increasingly willing to buy recycled plastics. There have also been significant changes in the waste management regulatory landscape. Historically, China was the end-destination for much of the world’s plastic. But in January 2018, China banned imports of various solid wastes including plastics. In 2016, the EU exported around 300,000 tonnes of plastic waste per month, primarily to China. And while other countries such as Malaysia, Indonesia, Turkey and Vietnam have taken up some of the slack, volumes of waste plastic exported from the EU has still plummeted by around half.

Plastic recycling targets are also being hiked up beyond proportions possible to be recoved by mechanical recycling alone. The EU, for example, has agreed targets of 65% of packaging materials to be recycled by 2025, rising to 70% by 2030.

A handful of chemical recycling technologies have come online at a commercial scale in the past few years aiming to fill the gaps between increasing quotas and mechanical recycling capacities. Numerous other systems have also proven themselves at the pilot scale and are starting to be scaled up. These encompass many different chemistries but can be grouped into three broad categories: decomposition into hydrocarbon mixtures (such as naphtha), depolymerisation into constituent monomers, and conversion into chemicals other than constituent monomers. There is also a fourth, related, technology: physical separation of intact polymer chains.

Decomposition into mixtures

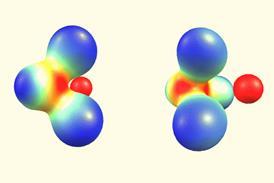

Most of the hydrocarbons in plastic originate from natural gas and crude oil. Once extracted, these mixtures of thousands of different compounds are distilled to separate them into fractions by molecular weight. The fraction containing hydrocarbons with between four and 11 carbon atoms – naphtha – is used for plastic production. The naphtha is cracked to produce lighter hydrocarbons before being further purified and processed to create a host of compounds, including those suitable for use as plastic monomers.

Most chemical recycling technologies operating at a commercial scale today decompose waste plastic back into naphtha or similar hydrocarbon mixtures. These are then re-processed into new plastics using existing infrastructure.

Pyrolysis is the dominant plastic decomposition method, where the carbon–carbon bonds in polymer backbones are broken by heating them up in an oxygen-free atmosphere. Low or high pressure is also often used to facilitate bond breakage.

Plastic Energy currently operates commercial-scale plastic chemical recycling plants in Seville and Almeria in Spain. The plants each process around 15 tonnes per day of post-consumer plastic waste. ‘The polyethylenes, polystyrene and polypropylene are our target feedstock,’ explains David McNamara, chief technology officer at Plastic Energy. ‘It’s material that is not economically viable to be mechanically recycled, meaning it has typically gone for incineration or landfill in the past.’

The plastic is placed in a reactor where it is heated at low pressure causing the polymer molecules to break down and vaporise. The multi-component vapour is then condensed. ‘We produce a single stream component that we call Tacoil, which can be used as replacement feedstock for some of the naphtha crackers,’ McNamara explains. A fraction of lighter hydrocarbons is also collected then burned to power the plant.

Plastic Energy is working with Saudi petrochemical company Sabic to use Tacoil as a feedstock to produce polyethylene and polypropylene. Following a successful trial in early 2019, a 20,000 tonnes per year plant is being installed at Sabic’s manufacturing site in Geleen, the Netherlands. The projected launch date is 2021 with confirmed customers for the recycled plastic produced including Unilever, Vinventions, Walki Group and Tupperware.

Similar plants in other countries are in the pipeline. ‘The plan is to have 10 plants under operation or being built by 2023,’ McNamara explains.

Closer to home

In the UK, construction is underway at the country’s first two commercial-scale chemical recycling plants. These will both produce naphtha-equivalents from post-consumer plastic waste. Recycling Technologies is building a 20 tonnes per day plant at the Ecopark in Perth and ReNew ELP is constructing four 70 tonnes per day units at the old Teesside ICI plant in Redcar.

Recycling Technologies has developed a pyrolysis-based system for recycling polyethylenes and polypropylene. ‘We distil two main fractions,’ explains Elena Parisi, sales and marketing director at Recycling Technologies. These outputs are coined Plaxx. The heavier fraction is a waxy solid. ‘We have a commercial agreement to sell this to a UK company called Kerax [who will use it to produce items ranging] from candles to coatings,’ Parisi says. The second, larger fraction is a liquid and Recycling Technologies is working with a confidential partner to post-process this to make it suitable for cracking, she adds. ‘Once it enters a steam cracker then it is like-to-like for any other standard naphtha liquid feedstock that is used for new polymer production.’

The recycling system is currently being built at the Recycling Technologies’ headquarters in Swindon ahead of transportation to Scotland. The Ecopark launch is planned for late 2020/early 2021. Parisi says the company’s goal is to mass-produce its units for global distribution. And, in October 2019, the company announced it was entering a partnership with global energy company Total and global brands Nestlé and Mars to run a feasibility study in France.

ReNew ELP’s technology is licensed from London-headquartered Mura Technology, but it was first developed in Australia as a means to extract oil from brown coal. Rather than using a pyrolysis vessel, the core of this system is a catalytic hydrothermal reactor. It uses a combination of supercritical water and catalysis to decompose plastic polymers and vaporise the resulting hydrocarbons.

Plastics that are too contaminated for traditional recycling are our target

The vapour is then distilled. ‘We are looking at producing four liquid products,’ explains Richard Daley, managing director at ReNew ELP: a naphtha fraction, two different gas oils and a wax. The two gas oils will undergo further processing to produce commodity chemicals and the wax will be sold ‘as an aggregate into the asphalt industry’, Daley says. Construction of the first 70 tonnes per day unit is planned for mid-2020, with the others following shortly after.

Daley describes the Mura Technology process as ‘very much polymer agnostic’ and says ‘plastics that are too contaminated or too mixed for traditional recycling are our target’. Mura Technology is looking to license the technology worldwide, he adds. It is also partnering with the government of East Timor to trial the technology in a non-profit venture. This island nation around 300 miles north of Australia currently has no waste-processing infrastructure meaning everything goes to landfill with significant leakage into the ocean.

Depolymerisation into monomers

The main outputs of the above chemical recycling technologies are naphtha, or naphtha-equivalents, that re-enter the normal plastic production process at the steam cracker stage. Other technologies are looking to break the polymers directly back into their starting monomers, meaning fewer steps are required to convert waste plastic into new plastic. The recycling loop is shorter.

Our waste comes from lots of different sources and includes everything from clean foam to agricultural trays with dirt in them

The low-pressure pyrolysis technology developed by Agilyx in the US state of Oregon can do both. It depends on the feedstock recipe, explains Joseph Vaillancourt, chief executive officer of Agilyx. The company opened its first polymer-to-monomer commercial scale plant at its Tigard site in 2018. ‘This plant has been operating for over a year turning polystyrene into styrene monomer,’ Vaillancourt adds.

The plant processes 9 tonnes of polystyrene per day. ‘Our [waste] polystyrene comes from lots of different sources and includes everything from clean foam to rigid, black agricultural trays with dirt and fertiliser in them,’ Vaillancourt says. The styrene monomer is sold to Texas-based chemical company Americas Styrenics for re-processing into food-grade polystyrene.

Agilyx is currently ‘in various stages of developing plants with 15 different customers’, says Vaillancourt. R&D work aimed at expanding the range of plastics that can be recycled back into their monomers is also ongoing. ‘One of the more exciting R&D projects in progress orients itself around PET,’ he adds. Polyethylene terephthalate (PET) has two monomers – ethylene glycol and terephthalic acid – making it more challenging to recycle than plastics with a single monomer.

Another company looking to chemically recycle PET is Loop Industries, based near Montreal in Canada. ‘We have invented a process where we do a very low-temperature methanolysis,’ explains Daniel Solomita, founder and chief executive officer of Loop Industries.

Loop Industries breaks the PET down into ethylene glycol and the methyl ester of terephthalic acid, dimethyl terephthalate. It then carries out the re-polymerisation step in house. The company’s first commercial scale plant – a collaboration with the chemical company Indorama Ventures – is expected to be commissioned in South Carolina in late 2021. ‘The annual output of the facility will be 40,000 metric tonnes of PET resin,’ says Solomita. Waste PET to be recycled will include carpets, clothing and post-consumer plastic waste. Companies that have signed partnerships to use the recycled PET includes L’Oréal, PepsiCo and Coca-Cola. Plans for additional plants worldwide are in the works, Solomita adds.

Conversion into something else

Another chemical recycling initiative completing the loop from waste plastic to recycled plastic in house is BioCellection, based in California, US. Its target waste is the polyethylenes, says Jennifer Le Roy, director of R&D at BioCellection.

Polyethylenes undergo a slow oxidative breakdown in the environment, explains Le Roy, and ‘we have invented a way to accelerate that in a commercial process’. Shredded polyethylene is placed into a reactor with an oxidative mixture and heated to nearly 200°C. Instead of producing ethylene monomer, the decomposition process produces short-chain dicarboxylic acids that BioCellection uses to create new materials. ‘These are common chemical building blocks used to synthesise many polymers including polyesters, polyurethanes and polyamides,’ says Le Roy. ‘Our technology is upcycling technology – we’re taking trash and creating new high performance polymers from it.’

The BioCellection reactors currently process 2kg of waste plastic per day, but scale up plans are expected to be announced soon.

Separating mixtures

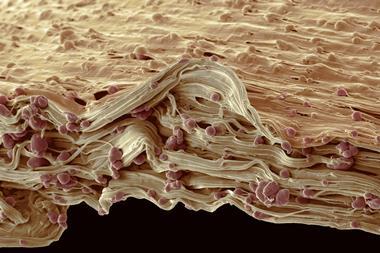

Meanwhile in Merseburg, Germany, plastic recycling company APK are trying to shorten the recycling loop by physically separating intact polymers. ‘We are doing a solvent-based separation of the polymers,’ explains Marta Heuser, product development engineer at APK. ‘There is no chemical reaction during the process.’ The APK process is currently tailored towards multilayer, low-density polyethylene and polyamide packaging films.

Low-density polyethylene dissolves in the solvent while polyamide remains in the solid phase, explains Heuser. APK opened its first commercial-scale plant in summer 2019. ‘The input material is off-spec materials from film producers,’ she says. The recovered polyethylene pellets are then sold to film producers for re-processing back into films and the polyamide sold for injection moulding applications such as in the automotive industry.

That will be the holy grail: a high-performing plastic that you can easily recycle

The Merseburg plant currently recovers 8000 tonnes of polymer pellets a year. The location for a second plant, capable of recovering 20,000 tonne per year, is being finalised. ‘The second plant will also work with post-consumer material,’ Heuser says.

These companies are just a snapshot of a booming industry. ‘We have about 300 companies selling new technology just in Europe for chemically recycling plastic waste,’ explains Van Geem.

ReNew ELP’s Daley welcomes all of these into the market place: ‘We need all these different technologies that are focusing on different polymers, or polymers in general, to work if we are to meet our recycling targets.’ Van Geem notes that not all these technologies are yet producing an output that is actually useful. ‘Some waste companies produce a naphtha stream that does not meet the specifications required for petrochemical companies,’ he explains. Communication and collaboration is the key, but regulation will also help. ‘It’s a new disruptive technology that’s outpaced the legislation regulations,’ Daley says. ‘We fit within existing regulations, but as the sector grows governments will have to consider looking at specific legislations to drive focused development and growth,’ adds Recycling Technologies’ Parisi.

Plastic waste is, as former UK prime minister Theresa May said, ‘one of the great environmental scourges of our time’. Slashing unnecessary plastic use must remain plan A. But a completely circular economy for the plastic we must use is becoming an ever more important and viable plan B. Chemistry has two roles to play, improving chemical recycling and designing novel plastics that are easier to recycle. ‘But that will be the holy grail: a high-performing plastic that you can easily recycle,’ Van Geem explains.

Nina Notman is a science writer based in Salisbury, UK

The plastics problem

- 1

- 2

Currently reading

Currently readingPlastic recycling heading for the mainstream

- 3

- 4

- 5

- 6

- 7

No comments yet